We are fans of Business Model Generation and the book’s centerpiece, The Business Model Canvas:

The Business Model Canvas is a superior alternative to text-heavy business plans.

The book is characterized by:

- the use of concise, visual representations

- the use of many models, and

- an emphasis on iterative experimentation

Defining “Business Model”

Let’s start by clarifying what we mean by “business model”:

A business model describes the rationale of how an organization creates, delivers, and captures value. – Business Model Generation

In other words, a sustainable business must do the following:

- Offer compelling value to customers

- Deliver the goods—figuratively and literally, and

- Generate a sufficient profit

Designing a business model isn’t a straightforward optimization problem. Rather, it’s a dynamic balancing act replete with competing objectives and contradictions.

When You Already Have a Business

The Business Model Canvas emerged on the entrepreneurship scene as a refreshingly operational tool in a space cluttered by variations on pro-forma-based business plans. It invited founders to think not only about how fast they wanted their start-ups to grow but also about what resources and relationships would be needed to achieve growth. But if you already have an ongoing business, how should you use the Business Model Canvas?

You can use the canvas to articulate facets of the business you want. Every business evolves as a blend of intention and opportunism and drift. Using the Business Model Canvas to consider your ideal clientele and most valued aspirations for what you want from engaging in business activities offers a wonderful strategic check-in. As an avid skier and mountain-biker friend says, “Don’t look where you don’t want to go—because you’ll go there. Keep your eyes on where you do want to go.”

After you have a canvas that articulates aspects of the business you want, you may also want to jot ideas about facets of the business you currently have on another canvas. The activity may reveal useful ideas about which aspects of your business must change so that you can generate momentum in the direction you desire.

The Building Blocks of a Business Model

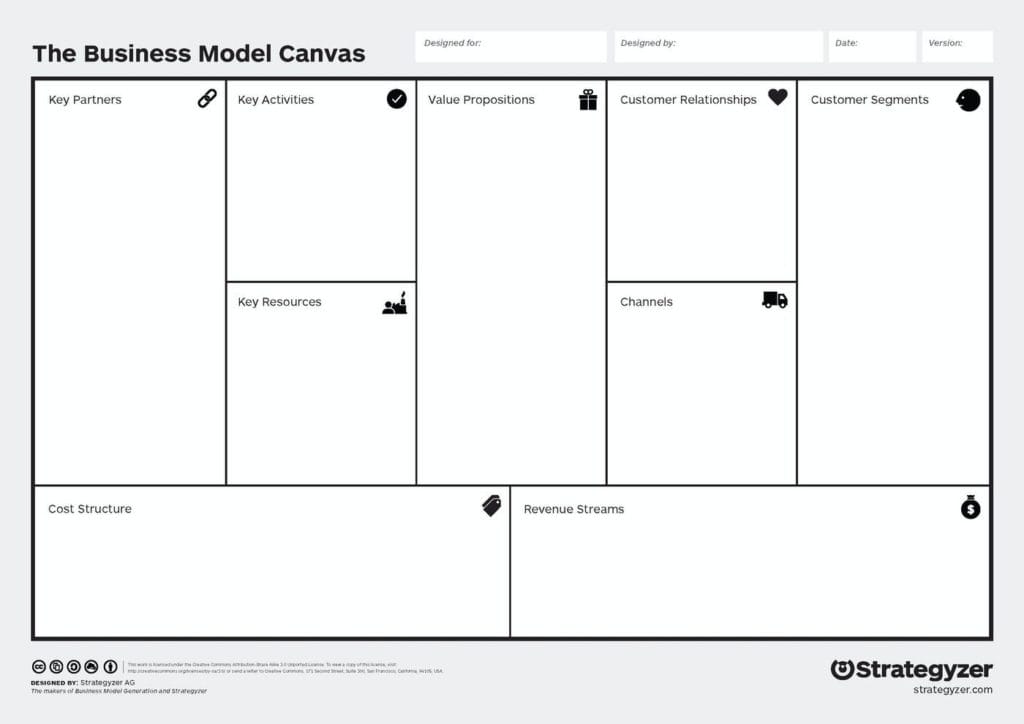

The Business Model Canvas proposes that a business model consists of nine building blocks:

- One or more well-defined Customer Segments

- Corresponding Value Propositions that match bundles of products and services to important customer jobs, essential gains, and extreme pains

- The Channels through which value propositions are communicated and delivered to targeted customer segments

- Customer Relationships established and maintained with customer segments

- The Revenue Streams resulting from the successful delivery of value propositions to customers

- Key Resources—tangible and intangible assets and accumulations—necessary to offer and deliver the preceding

- The Key Activities related to the cultivation, use, and sustainment of key resources over time

- Key Partnerships that represent access to certain key resources and the capacity to engage in key activities

- The Cost Structure resulting from the resources, activities, and partnerships that make the delivery of your value proposition possible

Customer Segments and Value Propositions

We addressed the Customer Segment and Value Proposition building blocks at length in previous lessons:

Channels

A Channel bridges the gap between a producer of a product or provider of a service and a customer. More specifically,

- Marketing information about the product or service—and the product or service itself—must somehow be delivered to the customer at the right place and time.

- In turn, money needs to move from the customer back to the producer or provider.

So, a channel must perform these essential marketing, logistical, and transactional functions:

- Marketing functions include gathering information about potential customers and using that information to segment the market and generate demand.

- Logistical functions include storing, packaging, and transporting your product. Even if you are selling a service, you still need to deliver the output of your service to your customer.

- Transactional functions include processing the sale and negotiating who assumes the risks associated with ownership, fulfillment, payment, and performance.

Customer Relationships

The Customer Relationships building block captures a qualitative description of the intended relationship between the company and its customers ranging from personal to automated. Categories of customer relationships include:

- Personal assistance, including dedicated personal assistance

- Self-service, which may include elements of automation, and

- Co-creation and communities that represent an ongoing collaboration

Furthermore, the authors assert that the nature of customer relationships are driven by the following motivations:

- Customer acquisition

- Customer retention

- Boosting sales (up-selling)

We believe that customer relationships merit status as a building block because the accumulation of customers over time represents a universal key resource requiring key activities to build and maintain.

We’ll explain the visual language used in the following image in The Grammar of Stocks and Flows. In the meantime, consider the following:

- The level of customers over time is a function of (1) the rate at which customers are acquired relative to (2) the rate at which customers are lost.

- Revenue, in turn, is a function of (3) the current level of customers, their average purchase frequency, and the average purchase value.

Customers represent a Key Resource that requires Key Activities associated with (1) acquiring, (2) retaining, and (3) up-selling to generate revenue over time.

While the customer relationships building block provides a useful, qualitative description, the preceding, called a stock-flow map, more clearly illustrates how customer relationships describe the key activities associated with building and maintaining the level of active customers over time—a key resource.

Revenue Streams

Revenue Streams can be derived from customer relationships in a variety of ways and are more or less recurring. The pricing associated with revenue streams can be fixed or dynamic.

- An asset sale is the most familiar form of revenue stream. It’s derived from selling the rights of ownership to a physical product—a book, for instance.

- A usage fee derives from the one-time use of a service—the overnight delivery of a parcel, for example.

- A subscription fee gives customers ongoing access to a service, while various forms of renting give customers continuous access to a physical asset.

- Other forms of revenue streams include the licensing of intellectual property, brokerage fees for facilitating transactions or other connections, and advertising fees resulting in payments to access an audience.

Key Resources and Activities

Key Resources and Key Activities are inextricably linked. Resources are accumulations that drive performance over time. They might be assets reflected on your balance sheet—such as cash, manufacturing equipment, or inventory. However, they might also be less tangible accumulations such as customers, awareness, trust, or operational capacity.

Key Resources are accumulations that drive performance over time—that is, they are strategic. Key Activities are those that influence the levels of Key Resources.

Customers aren’t an asset in the sense you can’t own them. Nevertheless, you must have ready access to key resources—directly or through a Key Partner—in order to execute your business model.

As alluded to previously, Key Activities are those that impact the increase or decrease of Key Resources over time. Just as key resources vary from business-to-business, so will Key Activities.

Here are a few examples of Key Resources and some of the Key Activities associated with them:

- Service Capacity: hiring, training, and retaining employees

- Inventory: designing, procuring, manufacturing, shipping

- Customers: marketing, selling, providing customer support

The identification of a Key Resource should trigger questions about the associated Key Activities. Conversely, the sense that an activity is key should trigger questions regarding the associated resource.

Key Partners

Businesses engage with Key Partners to gain reliable access to Key Resources and/or the capacity to engage in Key Activities. Partnerships can also represent opportunities to share risk. Key partnerships can take a variety of forms, including:

- Strategic alliances

- Joint ventures

- Buyer-seller relationships

Potential partners might enjoy economies of scale or scope or access to resources that would be difficult or impossible to replicate. Their relative advantage creates opportunities for mutually beneficial trade.

A maker of specialty consumer products, for example, might cultivate a special relationship with a design firm in order to ensure the capacity to develop a steady stream of innovative products. In this case, the design firm presumably has proprietary access to a differentiated level of skill—its key resource—that would be difficult for the consumer products company to replicate.

Cost Structure

The Cost Structure building block describes the most important costs associated with operating a particular business model. The most important costs tend to be those associated with Key Activities.

Some business models are more cost-sensitive than others. A budget housekeeping service will be more cost-driven than will be a highly personalized concierge service.

Costs can be more-or-less fixed or variable. They can benefit from economies of scale and scope or, quite possibly, dis-economies of scale and scope. For example, business models that depend on maintaining a staff of highly creative and motivated employees may find that growth can be disadvantageous because the resulting bureaucracy may be anathema to creatives who value autonomy.

Advantages and Limitations

We think The Business Model Canvas is an excellent place to start a conversation. Like any model, though, it has limitations.

What’s Good About the Canvas

The concise, visual layout of the Business Model Canvas facilitates conversation and iteration. That’s particularly true when used in a large format with Post-it notes with a group. Furthermore, the layout of the nine building blocks on a single page implies a sense of inter-relationships.

The layout of the canvas is suggestive of the inter-relationships among the building blocks of the business model.

- Customer Segments and Value Propositions are connected through Channels and Customer Relationships.

- The preceding blocks are related to Revenue Streams.

- The delivery of Value Propositions requires reliable access to Key Resources the levels of which are driven by Key Activities.

- Key Partners can provide access to Key Resources and undertake Key Activities on behalf of the business.

- The Cost Structure is largely a function of the performance of Key Activities.

- Revenue Streams relative to the Cost Structure determine profitability and sustainability.

The Limits of The Business Model Canvas

The Business Model Canvas also has some shortcomings:

- The canvas is a static picture—a snapshot. Strategy relates to the management of performance over time. A strategy is dynamic and requires “thinking in movies”.

- The inter-relationships suggested by the canvas are implied rather than explicit.

- The canvas is qualitative. It lacks quantitative rigor.

The specification of inter-relationships and quantities can be hard. But ultimately, quantification is essential for understanding the conditions necessary for a business model to be viable over time.

Key Ideas

- A business model describes the rationale of how an organization creates, delivers, and captures value.

- If you already have an ongoing business, you can use the Business Model Canvas to articulate the facets of the business you want.

- The accumulation of customers represents a Key Resource that requires Key Activities associated with acquiring, retaining, and up-selling to generate revenue over time.

- Key Resources and Key Activities are inextricably linked. Key Resources are accumulations that drive performance over time. That is, they are strategic. Key Activities are those that influence the levels of Key Resources.

- Key Partners provide access to Key Resources and/or the capacity to engage in Key Activities.

- The single-page layout of the Business Model Canvas facilitates conversation and iteration.

- However, the Business Model Canvas is static and lacks quantitative rigor.